The automated intercompany process in the system will automatically create Due To and Due From entries on the distribution of intercompany transactions. A transaction is deemed intercompany if the location in the header belongs to a different legal entity than a location in the detail rows belongs to. The intercompany entries are added to the distribution after hitting Save or Approve.

The Legal Entity form has fields for “Due From Account” and “Due To Account” and these are the accounts that will be used in intercompany distributions. The process below describes an example of how this would work.

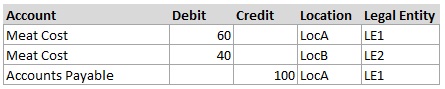

Assume we have 2 locations and each is owned by a different legal entity (LocA owned by LE1 and LocB owned by LE2). Let’s assume a vendor delivers $60 of goods to LocA and $40 of goods to LocB but then sends 1 consolidated invoice for $100. If the invoice is entered at LocA then that means LocB should owe LocA for their $40 portion of the expense. On the invoice, LocA will be the location in the header and then there would be 2 details rows, 1 for LocA for $60 and 1 for LocB for $40. The distribution without intercompany would be as shown below.

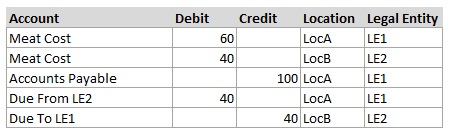

Total debits and credits must balance for each legal entity so the example above is out of balance. Total debit for LE1 = 60 and total credit = 100, while total debit for LE2 = 40 and total credit = 0. LE2 needs a $40 credit and LE1 needs a $40 debit to balance out. That’s where the Due To and Due From entries come in. Automated intercompany rows will be created to balance out the entry and show that LE2 owes LE1 $40 as shown below.

Now debits and credits match for each legal entity and the transaction is in balance. The Due To and Due From accounts were pulled from each respective legal entity.

Setting Up Due To/From Accounts

There are 2 methods to choose from when setting up Due To/From accounts on a legal entity. Method 2 is more popular.

- Use separate due to and due from accounts for each legal entity. This means in our example on LE1 we’d put an account named “Due From LE1” in the Due From Account field and “Due To LE1” in the Due To Account field.

- Pros: This method provides the most detail because each legal entity will have their own due from and due to accounts so they will show up separately on a balance sheet

- Cons: Requires setting up more accounts in your GL, makes reports like the balance sheet longer because they must show each account, and the biggest con is that as the Due From and Due To account balances grow over time, at some point you should do an adjusting journal entry to cancel them out against each other. For example if Due To LE1 grows to a balance of $10,000 then that shows as an asset on LE1 balance sheet which looks good, but the if if it also has a liability of Due From LE1 = $9,000 then the net difference is actually just an asset of $1,000 instead because the rest cancel each other out. Periodically you’ll want to do an adjustment to clear those amounts so they don’t grow over time to millions

- (preferred Method) – Use the same account in both due to and due from account fields per each legal entity. This means in our example on LE1 we’d put one account named “Due To/From LE1” in both fields.

- Pros: This makes managing the balances simpler because since you use the same account for due to and due from, as they get debited and credited it cancels itself out without the user needing to do manual adjustments to the balance as described in the cons of method 1 above. This also creates 1/2 the amount of intercompany accounts which is easier setup and makes reports shorter

- Cons: A little less visibility to see due to and due from balances separated out explicitly